Facts About International Debt Collection Uncovered

Wiki Article

What Does Dental Debt Collection Mean?

Table of ContentsWhat Does Debt Collection Agency Mean?Get This Report on International Debt CollectionRumored Buzz on Business Debt CollectionA Biased View of Debt Collection Agency

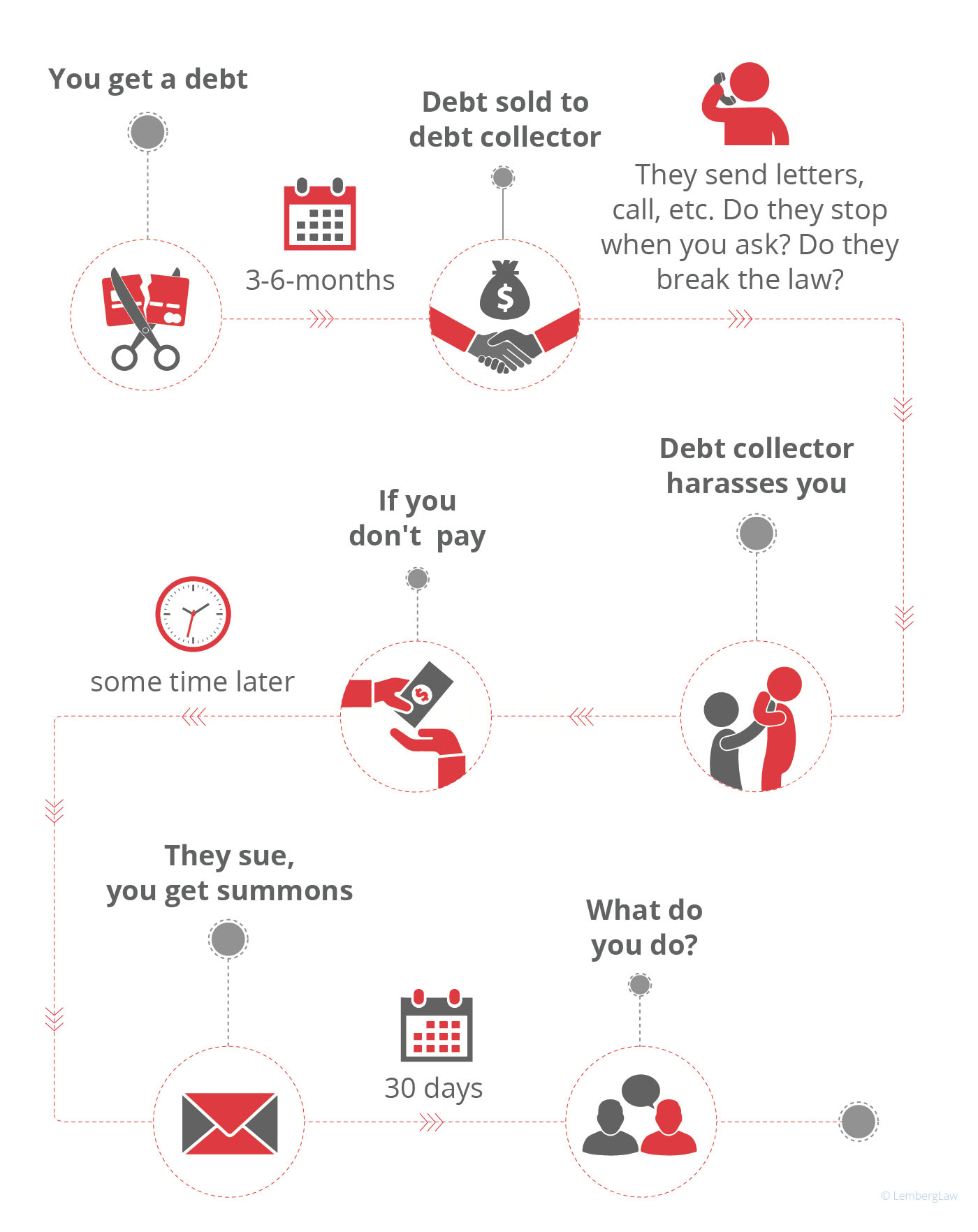

A financial debt enthusiast is an individual or company that is in the business of recovering money owed on delinquent accounts. Several financial debt collectors are hired by companies to which cash is owed by people, running for a flat fee or for a percent of the amount they are able to accumulate.

A financial obligation collection agency might additionally be called a debt collector. Below is how they work. A financial debt collection agency attempts to recuperate past-due debts owed to financial institutions. Debt collection agencies are often paid a percent of any kind of money they handle to gather. Some debt collectors purchase overdue debts from financial institutions at a discount rate and after that seek to collect on their very own.

Financial obligation enthusiasts who violate the guidelines can be filed a claim against. When a customer defaults on a financial obligation (significance that they have failed to make one or even more necessary repayments), the lender or lender may turn their account over to a financial debt collection agency or debt collection agencies. At that factor the financial obligation is stated to have gone to collections (International Debt Collection).

Overdue repayments on bank card equilibriums, phone costs, vehicle financings, energy costs, and also back tax obligations are instances of the delinquent financial obligations that a collection agency may be tasked with retrieving. Some companies have their own debt collection departments. Yet the majority of find it less complicated to employ a debt collection agency to go after debts than to chase after the clients themselves.

Dental Debt Collection - The Facts

Debt collection agencies might call the person's personal and also work phones, as well as even appear on their front door. They might additionally contact their family, friends, and also neighbors in order to confirm the call information that they have on declare the person. (Nonetheless, they are not enabled to disclose the factor they are attempting to reach them.) In addition, they might send by mail the borrower late payment notices.m. or after 9 p. m. Nor can they incorrectly claim that a borrower will certainly be arrested if they stop working to pay. Additionally, an enthusiast can not literally damage or threaten a debtor and also isn't allowed to confiscate assets without the approval of a court. The regulation also provides borrowers particular civil liberties.

People who assume a financial debt collector has actually broken the regulation can report them to the FTC, the CFPB, and also their state attorney general of the United States's office. They additionally have the right to take legal action against the financial debt collection agency in state or federal court. Yes, a debt collector might report a debt to the credit rating bureaus, but just after it has called the debtor about it.

Both can remain on credit rating records for approximately 7 years and have an unfavorable result on the individual's credit history, a huge part of which is based upon their payment background. No, the Fair Debt Collection Practices Act applies only to customer debts, such as home loans, bank card, auto loan, pupil car loans, as well as clinical expenses.

The Personal Debt Collection Ideas

Since scams are common, taxpayers ought to be skeptical of any person purporting to be functioning on part of the Internal revenue service as well as examine with the IRS to make sure. Some states have licensing demands for debt collectors, while others do not.Financial debt collectors give a helpful service to lenders and various other creditors that want to recover all or part of money that is owed to them. At the exact same time, the legislation offers particular customer protections to maintain debt collectors from coming to be as well click this hostile or abusive.

Generally, this details is provided in a written notification sent as the initial communication to you or within five days of their initial communication with you, and it might be sent by mail or online.

This notification usually needs to consist of: A declaration that the communication is from a financial debt collection agency, Your name and mailing details, along with the name and mailing info of the financial debt collection agency, The name of the creditor you owe the debt to, It is possible that more than one creditor will certainly be provided, The account number connected with the financial debt (if any kind of)An inventory of the current quantity of the financial obligation that reflects interest, charges, payments, and credit ratings considering that a particular day, The existing quantity of the financial debt when the notification is offered, Info you can make use of to reply to the debt collection agency, such as if you believe the debt basics is not your own or if the quantity is wrong, An end date for a 30-day duration when you can contest the debt, You may see other info on your notification, yet the info noted over typically need to be consisted of.

Not known Facts About Dental Debt Collection

Find out more regarding your financial debt collection defenses..

Say, you do not pay a credit scores card expense for one or more billing cycles. A rep of that card issuer's collection division might get to out to request settlement. When a financial obligation goes unsettled for a number of months, the original creditor will certainly frequently market it to an outside agency. The purchaser is referred to as a third-party debt collection agency."Debt collector" is an additional term made use of to describe third-party financial obligation collection agencies.

The FDCPA legitimately establishes what debt collection agencies can as well as can not do. They must inform you read the full info here the amount of the financial debt owed, share information about your legal rights as well as clarify how to challenge the financial obligation. They can likewise sue you for repayment on a financial obligation as long as the law of constraints on it hasn't ended.

Report this wiki page